Craig Callahan, DBA

Founder & CEO

- Portfolio Manager of the ICON Funds

- Created ICON’s proprietary valuation model

- Founded ICON in 1986

Economic Surprise!

Are Investors Expecting Poor Economic Conditions, Or Are Stocks in Position to Climb the Classic Wall of Worry?

Dr. Craig Callahan, ICON Advisers – Founder & President

July 30, 2020

Rather than reading the news, ICON uses intrinsic value. From horrible to mediocre to good, we believe value tells us what expectations are built into stock prices.

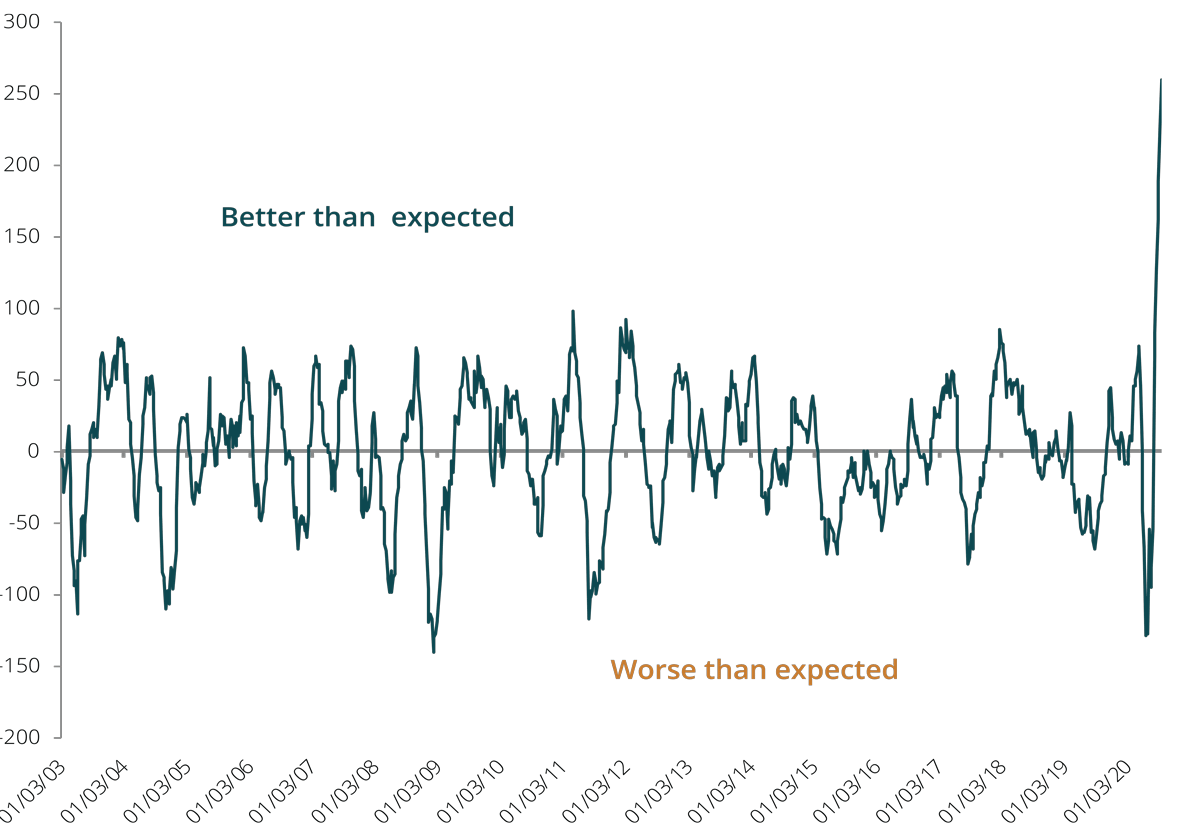

Citigroup Global Markets computes and distributes an index they call The Citi Surprise Index. They survey economists and analysts to get their forecasts for a variety of variables. Then Citigroup compares the forecasts to the actual data when it is released. The index measures data surprises relative to market expectations. A positive reading means that the data releases have been stronger than expected and a negative reading means that the data releases have been worse than expected.

Economic Surprise Index (United States), 1/3/03 – 7/17/20

Data Quoted represents past performance, which is no guarantee of future results

The graph shows the economic surprise reading weekly from January 3, 2003 through July 17, 2020. What stands out at the far right is the extreme level of data being better than expected, far exceeding other peaks.

Sensibly Stock Market Rally

In late March 2020, investors expected, and priced into stocks, a horrible economic setting. Then in the subsequent months investors realized that the economic setting was just bad, not horrible. It is very sensible to have a stock market rally when the expectation for horrible had been priced in and then investors realize that it is only bad. Here is an example. In late march many forecasters were predicting 20% to 25% unemployment. By April, it reached 14.1% and by June declined to 11.1%, which is bad but not as horrible as 20% – 25%. Continuing, if a bad economic setting is expected and it turns out to be just mediocre, the stock market rally can keep going. Then if the expectation of mediocre is priced in to stocks and as months pass the economy is okay, the rally lives on. The next step for the rally to continue is when the expectation for okay is priced in and the economy turns out to be good. Expectations and realizations moving from horrible to bad to mediocre to okay to good is the classic formula for a Wall Street rally. An old Wall Street expression is that “stocks climb a wall of worry.” To fully participate in the climb an investor needs to be one step ahead of the current news.

Rather than reading the news, ICON uses intrinsic value. From horrible to mediocre to good, we believe value tells us what expectations are built into stock prices. We estimate intrinsic value for over 1,800 domestic stocks and divide value by price to get a V/P ratio for each stock. On March 23, 2020, at the market bottom the average V/P was 1.61, an all-time high for our system. It suggested to us that investors were pricing in a potential horrible economic setting, such as the 20% to 25% unemployment mentioned earlier. From March 23, 2020, to July 15, 2020 the S&P 1500 Index gained 45.40% as investors apparently realized the economic setting was just bad, not horrible. ICON entered July 2020, with an average V/P of 1.37, suggesting investors expect a bad economic setting. If instead it proves to be just mediocre or okay, the rally can continue. Will investors go so far as to ever price in a great economic setting? We have seen it before, when the average V/P ratio was less than 1.00, but with today’s “wall of worry” we expect that could be a couple of years out.

The data quoted represents past performance, which is no guarantee of future results. Opinions and forecasts regarding sectors, industries, companies, countries and/or themes, and portfolio composition and holdings, are all subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security, industry, or sector.

Investing in securities involves inherent risks, including the risk that you can lose the value of your investment. An investment concentrated in sectors and industries may involve greater risk and volatility than a more diversified investment.

ICON’s value-based investing model is an analytical, quantitative approach to investing that employs various factors, including projected earnings growth estimates and bond yields, in an effort to determine whether securities are over- or underpriced relative to ICON’s estimates of their intrinsic value. ICON’s value approach involves forward-looking statements and assumptions based on judgments and projections that are neither predictive nor guarantees of future results. Value readings are contingent on several variables including, without limitation, earnings, growth estimates, interest rates, and overall market conditions. Although valuation readings serve as guidelines for our investment decisions, we retain the discretion to buy and sell securities that fall beyond these guidelines as needed. Value investing involves risks and uncertainties and does not guarantee better performance or lower costs than other investment methodologies.

ICON’s value-to-price ratio is a ratio of the intrinsic value, as calculated using ICON’s proprietary valuation methodology, of a broad range of domestic and international securities within ICON’s system as compared to the current market price of those securities. According to our methodology, a V/P reading of 1.00 indicates stocks are priced at intrinsic value. We believe stocks with a V/P reading below 1.00 are overvalued while stocks with a V/P reading above 1.00 are undervalued. For example, we interpret a V/P reading of 1.15 to mean that for every $1.00 of market value, there is $1.15 of intrinsic value which has not yet been realized in the market price.

The unmanaged Standard & Poor’s Composite 1500 (S&P 1500) Index is a broad-based capitalization-weighted index comprising 1,500 stocks of Large-cap, Mid-cap, and Small-cap U.S. companies. Total return figures for the unmanaged sector indexes do include the reinvestment of dividends and capital gain distributions but do not reflect the costs of managing a mutual fund.

The Citigroup Economic Surprise Indices are objective and quantitative measures of economic news. They are defined as weighted historical standard deviations of data surprises (actual releases vs Bloomberg survey median). A positive reading of the Economic Surprise Index suggests that economic releases have on balance [been] beating consensus. The indices are calculated daily in a rolling three-month window. The weights of economic indicators are derived from relative high-frequency spot FX impacts of 1 standard deviation data surprises. The indices also employ a time decay function to replicate the limited memory of markets. Source: Bloomberg

Please visit ICON online at InvestWithICON.com or call 1-800-828-4881 for the most recent copy of ICON’s Form ADV, Part 2.

ICON Blogs

More News and Views

Quick Search

Services and Solutions

Investment Products

About Us

ICON Advisers, Inc.

8480 E Orchard Road, Suite 1200

Greenwood Village, CO 80111

Investing in securities involves inherent risks, including the risk that you can lose the value of your investment. There is no assurance that the investment process will consistently lead to successful results.

Consider the investment objectives, risks, charges, expenses, and share classes of each ICON Fund carefully before investing. The prospectus contains this and other information about the Funds; please read the prospectus carefully before investing. RFS Partners, Distributor.

ICON Funds are offered only to U.S. citizens or residents of the U.S., and the information on this website is intended only for such persons. Nothing on this website should be considered a solicitation to buy or an offer to sell shares of any ICON Fund in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction.

ICON Advisers, Inc. is the sub-adviser to the ICON Funds. RFS Partners is the distributor of the ICON Funds.